How they work and what you need to know

What is a Standard Revolving Purchase?

A Standard Revolving Purchase is any purchase you make that does not qualify for a financing promotion.

How it works

Let's say you make a Standard Revolving Purchase.

•

Interest will be charged at the standard Purchase APR unless the purchase is paid in full by the first payment due date reflected on the first billing statement showing the purchase.

•

Only minimum monthly payments are required as set forth in your cardholder agreement.

•

If you make only the Minimum Payment each period, you will pay more in interest and it will take you longer to pay off your balance.

•

If you miss a payment or pay less than your minimum payment due, you will be charged a late fee.

Frequently Asked Questions

We've compiled a list of frequently asked questions about Standard Revolving Purchases to help you understand how these purchases work. Click on any of the questions below to learn more.

If you have any other questions, contact us at 1-800-252-2551.

Payments

If I make only my minimum payments, will I be charged interest?

Yes. You can choose to make only minimum monthly payments. But, if you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance.

If I make payments that are larger than my minimum payments, are those amounts always applied to my Standard Revolving Purchase balance?

Generally, yes. We first apply the amount over and above your minimum monthly payment to higher interest balances and older balances.

However, if you have a deferred interest promotional balance, any payment over and above your minimum during the last two months of the deferred interest promotional period will be applied to the deferred interest balance first.

You may have the option to re-direct the excess amount to other promotional balances if you have them. To do so, call us at the number on your account statement.

How do I make a payment?

It’s easy. We offer three convenient ways to pay your monthly bill.

By Phone

Call the phone number shown on your statement or on the back of your credit card.

By Mail

Department of Accounts

P.O. Box 33802

Detroit, MI 48232-5802

Please allow 7 days for your payment to reach us.

Balance Information

How long do I have to pay off my Standard Revolving Purchase balance?

As long as you make the minimum monthly payment, Standard Revolving Purchase Terms do not expire.

How do I avoid being charged interest?

You can avoid being charged interest by paying your balance in full each billing cycle. You most likely need to make more than your minimum payments to do this. You also need to consider other balances. They affect how your payments are applied.

Purchases

Can I make other purchases on my account?

Yes. You can make purchases up to your available credit limit.

But remember, other balances affect how your payments are applied. We first apply your payments to the minimum payments due for all balances. The portion of any payment that is larger than your minimum payment is an excess payment.

Generally, we first apply the excess payment to higher interest balances. But, if you have a deferred interest promotional balance, any excess will be applied first to the deferred interest balance during the last two months of the deferred interest promotional period.

Statements

Where can I find information about my Standard Revolving Purchases on my statement?

Your billing statement is designed to put all the information you need at your fingertips. Whether you receive paper or paperless statements, you can quickly review transactions, see your payment information and view all the details of your promotional purchases. Information about your Standard Revolving Purchases is found on your statement under “Summary of Promotional and Standard Balances.”

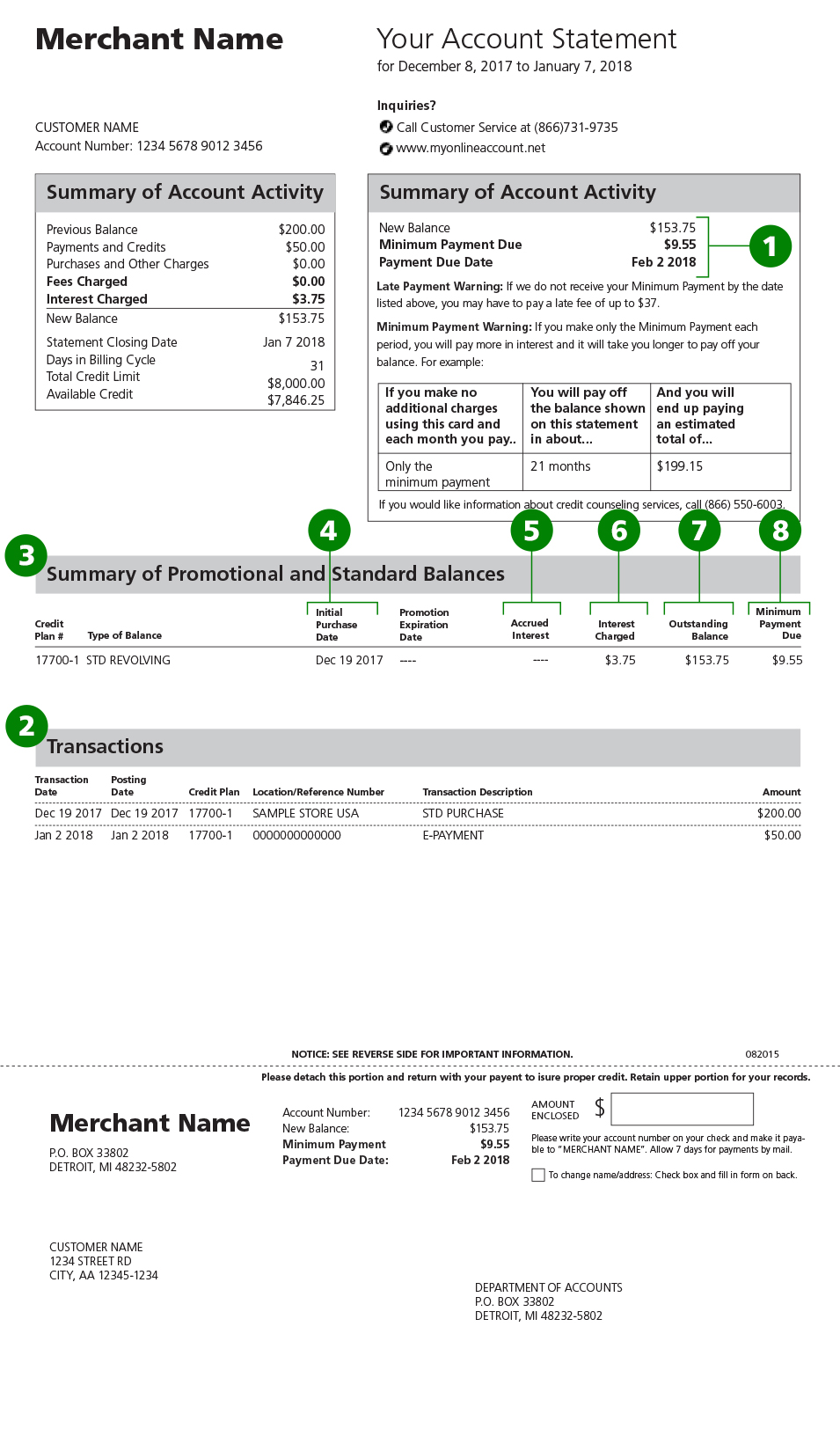

Minimum Payment Due

Make at least the minimum payment due each month by the due date shown. If you only make the Minimum Payment each period, you will pay more in interest and it will take you longer to pay off your balance.

Transactions

Summary of your payments and any recent transactions.

Summary of Promotional and Standard Balances

An overview of your Standard purchases.

Initial Purchase Date

When you made the purchase. Interest accrues from this date.

Accrued Interest

Interest accrued to date based on your Standard APR.

Interest Charged

The amount of Interest you are charged based on your balance, the Standard Revolving APR and the current billing period.

Outstanding Balance

The remaining amount you need to pay in order to pay off your balance.

Minimum Payment Due

The minimum amount you need to pay by your due date.

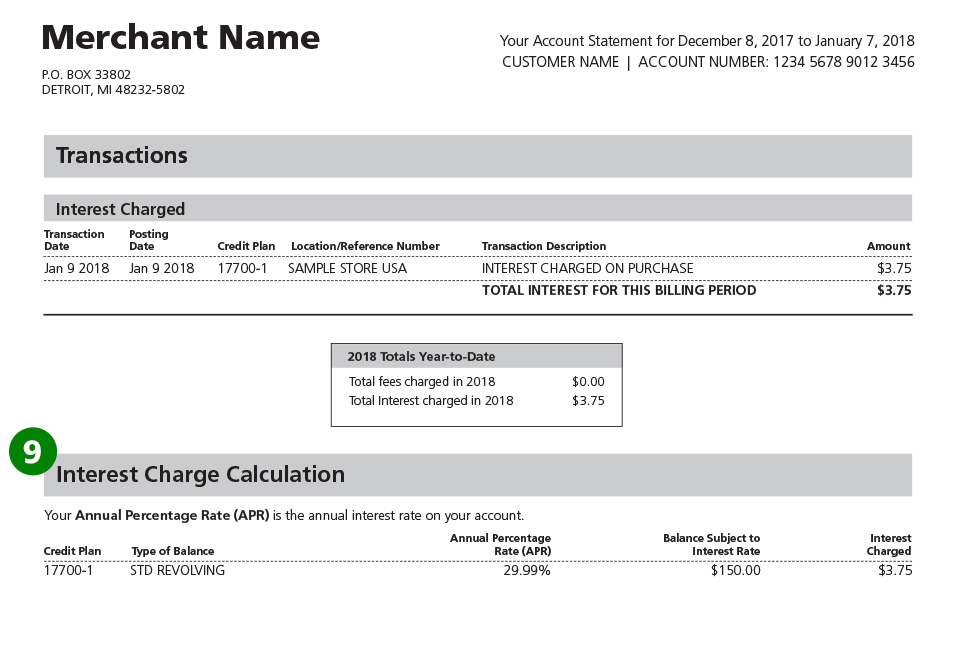

Interest Charge Calculation

Shows the APR of the interest on the Standard Revolving balance.

Where can I get my statement?

There are two ways you may receive your monthly billing statement.

By Mail

You will receive a paper statement in the mail every month unless you enroll in paperless statements.

Online

If you enroll in paperless statements, or if you want to see your account information online, log in to your account at myonlineaccount.net.